Capital gains tax on second home calculator

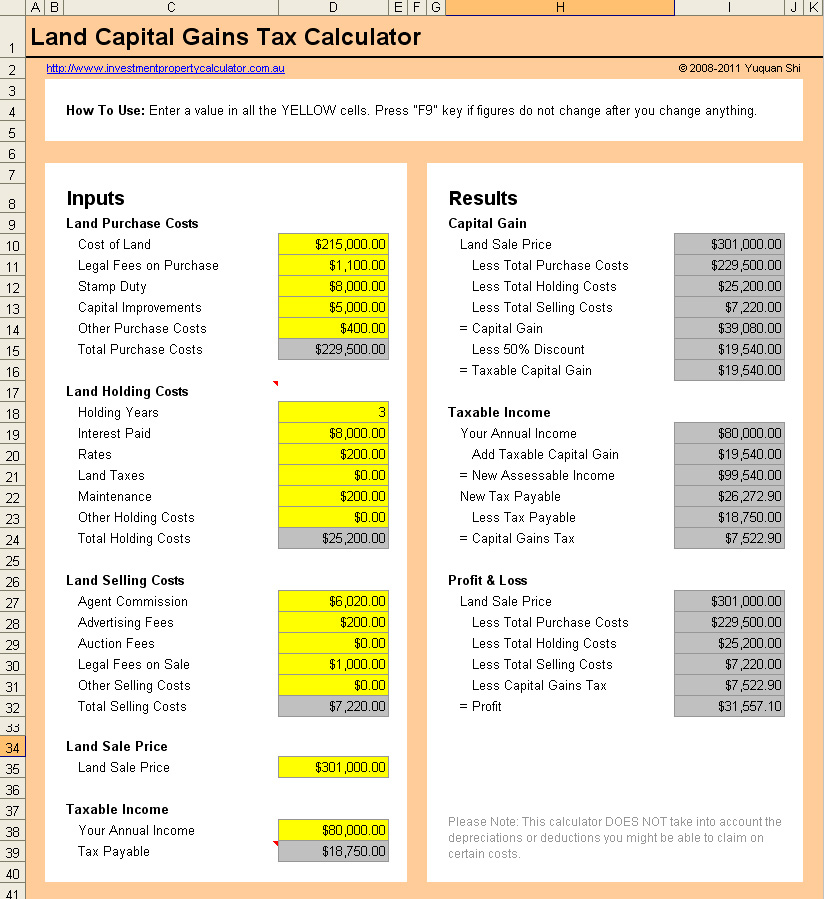

This real estate capital gains calculator should be used to estimate the capital gains tax you may pay if you sell your home or land or any other capital asset. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Tax Calculator Capital Gains Tax Cgt When Selling A Buy To Let Property Youtube

WOWA calculates your average capital gains tax rate by dividing your capital gains tax by your total capital gains.

. A capital gain represents a profit on the sale of an asset which is taxable. Frequently Asked Question Subcategories for Capital Gains Losses and Sale of Home. Work out your gain Your gain is usually the difference between what you paid for your property and the amount you got when you sold or disposed of it.

If your taxable income was 45000 and. The IRS allows taxpayers to exclude certain capital gains when selling a primary residence. Capital gains taxes on assets held for a year or less correspond to.

Capital gains and losses are taxed differently from income like wages. Income tax is charged at a flat rate of 19 on capital gains. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

Adjusted Cost Base ACB The adjusted cost base ACB is the. Add this to your taxable. If your combined capital gains are.

You will still have to pay. Discover Helpful Information And Resources On Taxes From AARP. That means youll get Private Residence Relief for 33 months or and skip on capital gains tax on the second home on 46 of the gain which is 23000.

Our Capital Gains Tax calculator gives you an estimate of how much you could have to pay in Capital Gains Tax CGT when you sell your property in the UK. The current federal limit on how much profit you can make on the sale of your principal residence that you have held for at least 2 years before you pay capital gains tax is 500000 for a. Our calculator can be used as a long-term capital gain calculator by increasing the duration of the investment.

Property Basis Sale of Home etc Stocks Options Splits Traders Mutual Funds Costs Distributions. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. Jun 30 2022 There are various ways to avoid capital gains taxes on a second home including renting it out performing a 1031 exchange using it as.

Simply enter your total earnings. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Its the gain you make thats taxed not the amount of money you receive.

However there are allowances made depending on the length of time you have owned the property known as the. You may have a capital gain or loss when you sell a capital asset such as real estate stocks or bonds. In the second article of his two-part series on tax impacts sellers of vacation homes should be aware of tax guru Julian Block discusses how to calculate capital gains tax.

First deduct the Capital Gains tax-free allowance from your taxable gain. The tax rate you pay on long-term capital gains can be 0 15 or 20 depending.

Property Tax Calculator Deals 56 Off Www Ingeniovirtual Com

How Much Is The Capital Gains Tax On Real Estate Ramseysolutions Com

Capital Gains On The Sale Of A Second Home Smartasset

Simple Tax Refund Calculator Or Determine If You Ll Owe

2021 Capital Gains Tax Rates By State

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

How To Calculate Capital Gains Tax When Selling A Home You No Longer Live In Capital Gains Tax The Guardian

How Do I Calculate Capital Gains On The Sale Of My Home

Capital Gain Tax Calculator 2022 2021

Tax Calculator For Rental Property Cheap Sale 57 Off Www Ingeniovirtual Com

How To Calculate Capital Gains Tax H R Block

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Solved Can You Avoid Capital Gains Taxes On A Second Home

Capital Gains Tax Calculator The Turbotax Blog

Capital Gains Tax Calculator 2022 Casaplorer

Capital Gains Calculator

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit